How We Started Teaching Differently

Most financial education feels disconnected from real life. You get theory, but when Monday morning comes, you still don't know how to actually build a budget that works or understand what your super statement means.

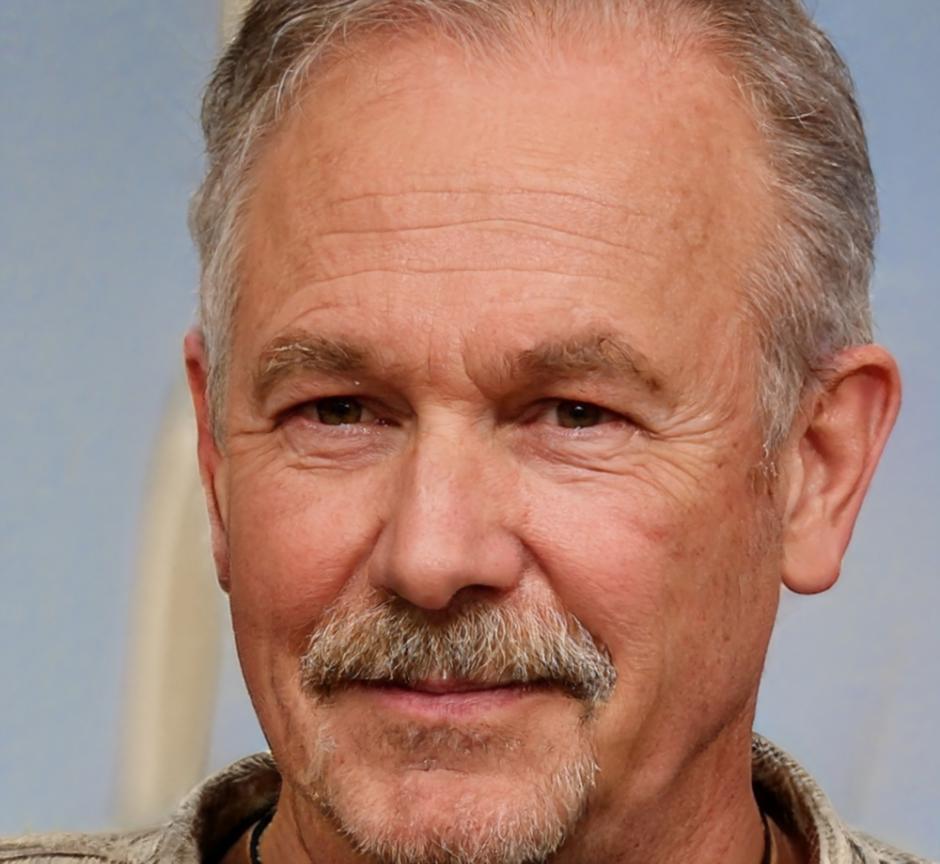

After working in financial planning for over a decade, I noticed the same questions kept coming up. People weren't asking about complex investment strategies – they wanted to know basic things like how mortgage interest actually works, or why their savings weren't growing as expected.

So we built sarnivethiq around those everyday questions. Our courses start with what you already know and build from there, using real Australian examples and current market conditions.